Let's suppose you buy an asset expected to increase in value, say a Degas painting, and want to track this. (The insurance company will care about this, even if nobody else does.)

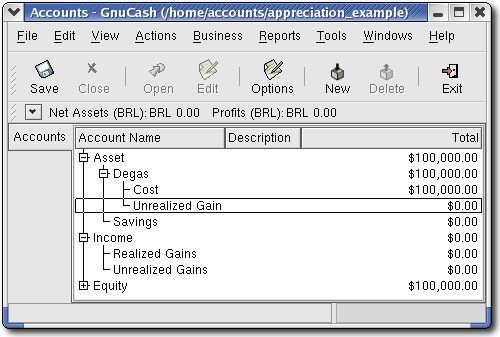

Start with an account hierarchy similar to than shown in the previous section, but replace "ITEM1" with "Degas" and you can remove the "ITEM2" accounts. We will assume that the Degas painting had an initial value of one hundred thousand dollars. Begin by giving your self $100000 in the bank and then transferring that from your bank account to your "Asset:Degas" account (the asset purchase transaction). You should now have a main account window which appears like this:

The asset appreciation example main window

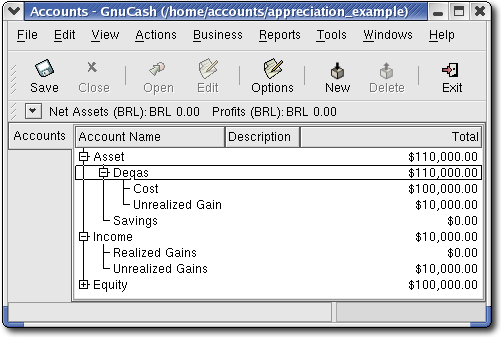

A month later, you have reason to suspect that the value of your painting has increased by $10000 (an unrealized gain). In order to record this you transfer $10000 from your Accrued Gains income account to your asset Unrealized Gains account. Your main window will resemble this:

This image shows the asset appreciation main window

Let's suppose another month later prices for Degas paintings have gone up some more, in this case about $20000, you estimate. You duly record the $20000 as an unrealized income like above, then decide to sell the painting.

Three possibilities arise. You may have accurately estimated the unrealized gain, underestimated the unrealized gain, or overestimated the unrealized gain.

Accurate estimation of unrealized gain.

Your optimistic estimate of the painting's value was correct. First you must record that the profits made are now realized gains, not unrealized gains. Do this by transferring the income from the "Income:Unrealized Gains" to the "Income:Realized Gains" account.

Secondly, you must credit your bank account with the selling price of the painting. This money comes directly from your "Asset:Degas" sub-accounts. Transfer the full "Asset:Degas:Cost" value into "Asset:Bank", and the full "Asset:Degas:Unrealized Gain" into "Asset:Bank".

These transactions should now appear as follows:

Table 9.1. Turning an Accrued Gain into a Realized Gain

Account Transfer to Transaction Amount Account Total Income:Unrealized Gains Income:Realized Gains $30000 $0 Asset:Degas:Cost Asset:Bank $100000 $0 Asset:Degas:Unrealized Gains Asset:Bank $30000 $0 This leaves the "Asset:Bank" account with a total of $130000 and "Income:Realized Gains" with a total of $30000.

Under estimation of unrealized gain.

You were over-optimistic about the value of the painting. Instead of the $130000 you thought the painting was worth are only offered $120000. But you still decide to sell, because you value $120000 more than you value the painting. The numbers change a little bit, but not too dramatically.

Under construction

Over estimation of unrealized gain.

You manage to sell your painting for more than you thought in your wildest dreams. The extra value is, again, recorded as a gain, i.e. an income.

Under Construction

As we see in this example, for non-financial assets, it may be difficult to correctly estimate the ``true'' value of an asset. It is quite easy to count yourself rich based on questionable estimates that do not reflect "money in the bank."

When dealing with appreciation of assets,

Be careful with your estimation of values. Do not indulge in wishful thinking.

Never, ever, count on money you do not have in your bank or as cash. Until you have actually sold your asset and got the money, any numbers on paper (or magnetic patterns on your hard disk) are merely that. If you could realistically convince a banker to lend you money, using the assets as collateral, that is a pretty reasonable evidence that the assets have value, as lenders are professionally suspicious of dubious overestimations of value. Be aware: all too many companies that appear "profitable" on paper go out of business as a result of running out of cash, precisely because "valuable assets" were not the same thing as cash.