When entering data in GnuCash, you should be aware of the 3 levels of organization in which GnuCash divides your data: files, accounts and transactions. These levels are presented in their order of complexity, one file contains many accounts and one account contains many transactions. This division is fundamental to understanding how to use GnuCash.

GnuCash uses files for storing information. GnuCash provides three types of files: data files, backup files, and log files. The main file that you will use to store your data is a data file. You will probably have only one data file that you use for your home data, but GnuCash will automatically save a backup copy for you each time you save that data file. GnuCash also provides log files which can be used to help reconstruct data. Backup and log files are described later in this chapter.

An account is a place for keeping track of what you own, owe, spend or receive. Although you only have one main data file, that file will contain many accounts. You probably already think of money you own or owe as being in an account. For example, at some point you opened checking and savings accounts at a particular bank, and that bank sends you monthly statements showing how much money you own in these accounts. Credit card accounts also send you statements showing what you owe to a credit card company, and the mortgage company may send you periodic statements showing how much you still owe on your loan.

In GnuCash, accounts are also used to categorize money you receive or spend, even though these are not physical accounts that receive statements. As we will cover more in Chapter 3, income type accounts are used to categorize money received (like a paycheck), and expense type accounts are used to categorize money spent (for pizza, to pay a bill, etc.) These accounts function much like categories in some other financial programs, with a few advantages discussed in Chapter 3.

A transaction represents the movement of money from one account to another account. Whenever you spend or receive money, or transfer money between accounts, that is a transaction. In GnuCash, as we will see in the next section, transactions always involve at least two accounts. Examples of transactions are: paying a bill, transferring money from savings to checking, buying a pizza, withdrawing money, and depositing a paycheck. Chapter 4 goes more in depth on how to enter transactions in GnuCash.

You've probably heard the saying, “Money doesn't grow on trees”. It means that money must come from somewhere - it doesn't just “appear”. Double entry accounting is a method of record-keeping that lets you track just where your money comes from and where it goes. Using double entry means that money is never gained nor lost - an equal amount is always transferred from one place to another. When you withdraw cash, you are transferring money from your bank account to your wallet. When you write a check to the grocery store, you are transferring money from your checking account to the grocery store. And when you deposit a paycheck, you are transferring money from your source of income to your bank account.

In GnuCash, these transfers are known as transactions, and each transaction requires at least two accounts. To enter the cash withdrawal, for example, you would enter a transfer of money from a bank account to a cash account. You would record the grocery check as a transfer from a checking account to a groceries expense account. And the paycheck deposit is recorded as a transfer from an income account to a bank account.

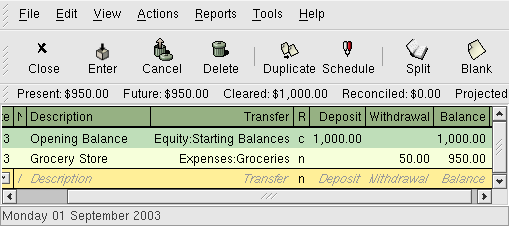

Unlike traditional accounting packages, GnuCash makes it very easy to enter your double entry transactions. Chapter 4 gives more detail on entering transactions, but for now let's take a general look at how they work. For a basic transaction like writing a check, you first create two accounts: a checking account and an account for the expense. For example, if you write a check to pay for groceries, then you need both a checking account and a groceries account. (See Chapter 3 for more detail on creating accounts.) To record the check, you simply enter a transaction to transfer money from the checking account to the groceries account. In this example, the GnuCash transactions look like this when viewed from the register windows of the checking account:

This image shows entering the date, description and transfer account for a payment of $50 to the Grocery Store.

In this transaction, a check is written to Grocery Store for $50. Since this is a double entry transaction, at least two accounts are affected and must be part of the transaction. GnuCash automatically enters the current account name (Assets:Checking) for you so you only enter the other account name affected (Expenses:Groceries).

| Note |

|---|---|

In this example for double entry accounting we used a checking account to pay for the groceries. But, notice that concept is the same no matter what method you use to pay for the groceries. If instead you used a credit card, the double entry accounting would simply involve your Credit Card account instead of the Checking account. | |

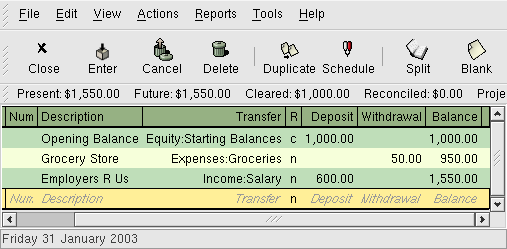

What about your paycheck? You can see that money goes into a bank account, but where does it come from? In double-entry, the money has to come from somewhere. Technically, that money comes from your employer, but you don't care about tracking your employer's accounts. So how do you account for money coming in? In GnuCash, you create a special income type account to track your incoming paychecks. (See Chapter 3 for more information on creating income accounts.) To record the paychecks, you simply enter a transaction to transfer money from the income account to a bank account.

Here's what a paycheck deposit looks like in GnuCash.

This image shows entering the date, description and transfer account for a $600 Salary payment from Employers R Us.

In this example, $600 is transferred from a Salary income account to the Checking Account. Because of the special nature of income accounts, discussed in Chapter 3, this transaction increases both the checking account balance and the income account balance by the amount transferred.

The main principle to remember is that there are at least two parts to every transaction, and the total amount transferred from a set of accounts must equal the total amount transferred to another set of accounts. When a transaction transfers an equal sum from accounts to other accounts, that transaction is said to be in balance. In GnuCash, as in double-entry accounting, you want to have all of your transactions in balance.

Why is this important to you? If all of your transactions are in balance, then your money is all accounted for. GnuCash has a record of where that money came from and where it was used. By storing the names of all accounts involved in each transaction, you provide data that can be sorted and viewed in report form later. Reports allow you to see things like how much money you made for the year and where it all went, what your net worth is, and what your taxes might be for the year. The more information you provide when entering transactions, the more detailed your reports will be.