A bill is the paperwork you receive from a customer requesting payment for a product or services you purchased. GnuCash can be used to generate and track bills.

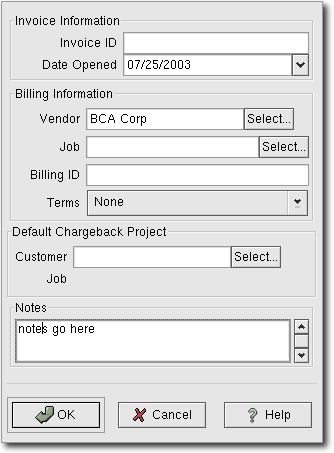

When you receive a bill from a vendor and want to enter it into GnuCash, you must create a new bill. This is accomplished using the application available at Business -> Vendors -> New Bill. The New Bill window should be filled in appropriately:

Invoice Info - Invoice ID (optional) - the identification number of the invoice as emitted by the vendor (IE: the vendor's internal number for this invoice).

Invoice Info - Date Opened - the date the Invoice was emitted by the vendor.

Billing Info - Vendor - the issuing vendor.

Billing Info - Job (optional) - the vendor job to associate with this bill.

Billing Info - Billing ID (optional) - the vendor's ID for the bill (e.g.: their invoice #). Can be left blank.

Billing Info - Terms - the payback terms agreement for this bill, a list of preregistered terms is available within the pop up menu.

Chargeback Project - Customer (optional) - the customer to associate with this bill, for purposes of charging the customer later.

Chargeback Project - Job (optional) - the customer job to associate with this bill.

Notes (optional) - any notes concerning the bill go here.

New Bill Registration Window

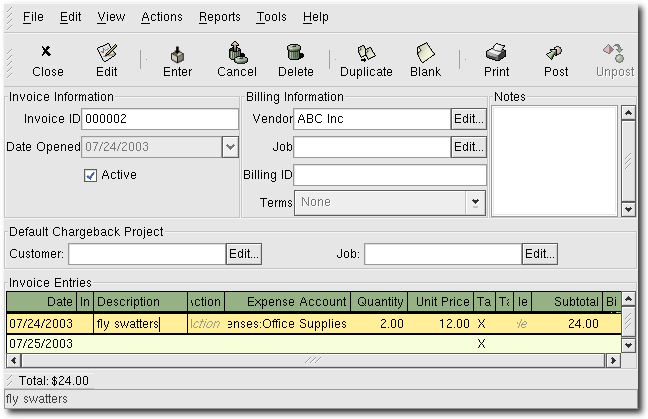

Once you fill in all the information for the new bill, you will be presented with the Edit Bill window.

From the Edit Bill window you can enter an itemized list of things purchased on this bill, in a manner similar to how the account register works.

Edit Bill Window

There are 11 columns in the Invoice Entries area:

Date - The date this item was sold

Invoiced? - X means the item is attached to this invoice, an empty box means the item is not attached to this invoice. If the box is empty you can attach the item to the invoice by first selecting the item row and then clicking in this box.

Description (optional) - what the item is called

Action (optional) - user defined field. Can place Cost Center info here, or use one of the 3 predefined actions, Hours, Material, or Project.

Expense Account - which expense account will be changed for this bill

Quantity - how many of the items were sold to you

Unit Price - the unit price of the item

Taxable? - is this item taxable? X means yes, a blank field means no.

Tax Included? - has the tax already been included in the unit price? X means yes, a blank field means no.

Tax Table (optional) - this is a pop up menu of all the available tax tables. If you set the item as taxable and set that the tax has not been included in the unit price, then this tax table is used to compute the amount of tax.

Subtotal (uneditable) - computed subtotal for this item (less tax)

Billable - is this item billable to the chargeback customer/job?

When you have finished entering all the items, Post the bill.

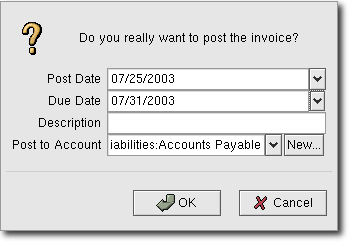

When you have finished editing a bill, you should Post the bill. You do not have to post the bill, you can simply close it and return to it later, however you need to eventually post it when you are finished editing. Posting the bill will place the bill transactions into an accounts payable account. The Post Bill window will appear asking you to enter the Post Date, the Due Date, a Description, and Post to Account (from which you can select from a list of A/Payable accounts).

Post Bill Window